May 1, 2024

Nominees for AIM Board of Directors

The Governance and Nominating Committee of the Associated Industries of Massachusetts Board of Directors has put forward the…

Read MoreIf you are not an AIM member - Consider joining. AIM Members receive access to all our premium content online.

If you're an AIM member please login to your AIM account to view this post:

Massachusetts employers appear to be just as ambivalent about the state of the economy as many experts.

Massachusetts

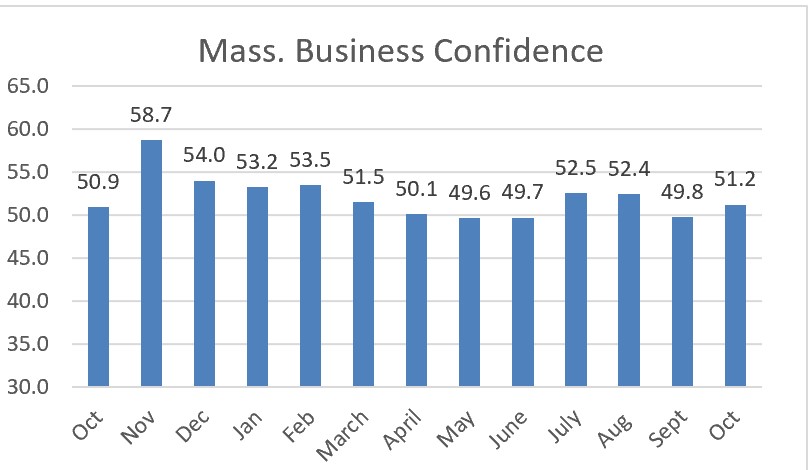

The Associated Industries of Massachusetts Business Confidence Index (BCI) last month continued to hover around the dividing line between optimism and pessimism. The Index rose 1.4 points to 51.2 during October, leaving it 0.3 points higher than in October 2022.

The BCI has moved for most of 2023 in a narrow range as employers attempt to gauge an economy that has proved surprisingly resilient in the face of rising interest rates, predictions of recession, and war in both Ukraine and the Middle East.

The strengthening of employer sentiment in October reflected brightening views of both the US and Massachusetts economies. The nation’s economy grew at a brisk 4.9 percent rate in the third quarter while Massachusetts maintained a record low unemployment rate of 2.6 percent. At the same time, financial markets weakened, with the S&P 500 and Dow Jones falling during October to post their first three-month losing streaks since 2020.

“Rapid increases in consumer and government spending continue to fuel the economy, suggesting the Federal Reserve may have to keep interest rates high for longer than it originally anticipated. A persistently tight labor market is exerting upward pressure on wages, leaving price inflation uncomfortably high,” said Sara Johnson, Chair of the AIM Board of Economic Advisors.

Participants in the Business Confidence Index Survey tempered their optimism with concerns about issues ranging from credit availability to business climate.

“I’m very concerned about the commercial real estate default rates accumulating on bank balance sheets. Since most are regional banks that lend to area businesses, this has already tightened credit and will only worsen as we begin to see the impact of non-performing loans (nationally and regionally),” wrote one survey participant.

Another commented: “Due to the business climate in Massachusetts … we are relocating corporate offices out of the state and will only maintain key individuals within the state. I’ve built multiple successful businesses in Massachusetts for over 20 years however Massachusetts is unfortunately no longer a state conducive to entrepreneurship. I would not have been able to build my prior businesses in the current climate, nor attract the talent that allowed us to thrive.”

The Central Massachusetts Business Confidence Index, conducted with the Worcester Regional Chamber of Commerce, fell from 46.9 to 45.7. The North Shore Confidence Index, conducted with the North Shore Chamber of Commerce, rose from 53.5 to 54.2. The Western Massachusetts Business Confidence Index, developed in collaboration with the Springfield Regional Chamber of Commerce also gained ground, from 52.5 to 54.1.

Constituent Indicators

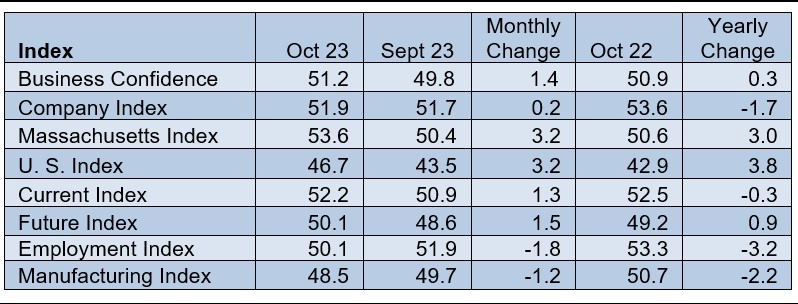

The constituent indicators that make up the Index were mostly higher during October.

The confidence employers have in their own companies gained 0.2 point to 51.9, ending the month 1.7 points less than in October 2022.

Massachusetts

The Massachusetts Index assessing business conditions within the Commonwealth increased by 3.2 points to 53.6, leaving it up 3.0 points from a year earlier. The US Index measuring conditions throughout the country ended the month at 46.7 – 3.8 points higher than a year ago.

The Current Index, which assesses overall business conditions at the time of the survey, rose 1.3 points points to 52.2. The Future Index, measuring projections for the economy six months from now, was up 1.5 points to move into optimistic territory at 50.1.

The Manufacturing Index lost 1.2 points to 48.5, falling 2.2 points below its level of a year ago. Confidence among non-manufacturing companies was up 2.3 points to 52.1.

The Employment Index fell 1.8 points to 50.1.

Large companies (50.9) were slightly more optimistic than medium-sized companies (50.5) and small companies (50.5).

Alan Clayton-Matthews, Professor Emeritus of Economics and Public Policy at Northeastern University, Senior Contributing Editor at MassBenchmarks and a BEA member, said the Massachusetts and US economies have so far defied expectations of a slowdown, but all indications are that growth can be expected to slow in the coming months.

“Unemployment in Massachusetts remains at record lows, but we hear anecdotally from some companies in the BCI survey that they have been able to find more qualified workers than they did a year ago. Massachusetts must still reckon with the structural demographic, educational and other factors that will affect labor supply in the long term,” Clayton-Matthews said.

Housing

AIM President Brooke Thomson, also a BEA member, said the Healey Administration’s recent $4 billion proposal to address the critical shortage of housing in Massachusetts will create economic benefits for employers and workers alike.

“Virtually every employer in Massachusetts has at one time heard a valued employee say: ‘I love working for this company, but my family can’t afford a house here.’ AIM looks forward to working with the Healey-Driscoll Administration and the Legislature to ensure those conversations become a thing of the past,” Thomson said.

Massachusetts

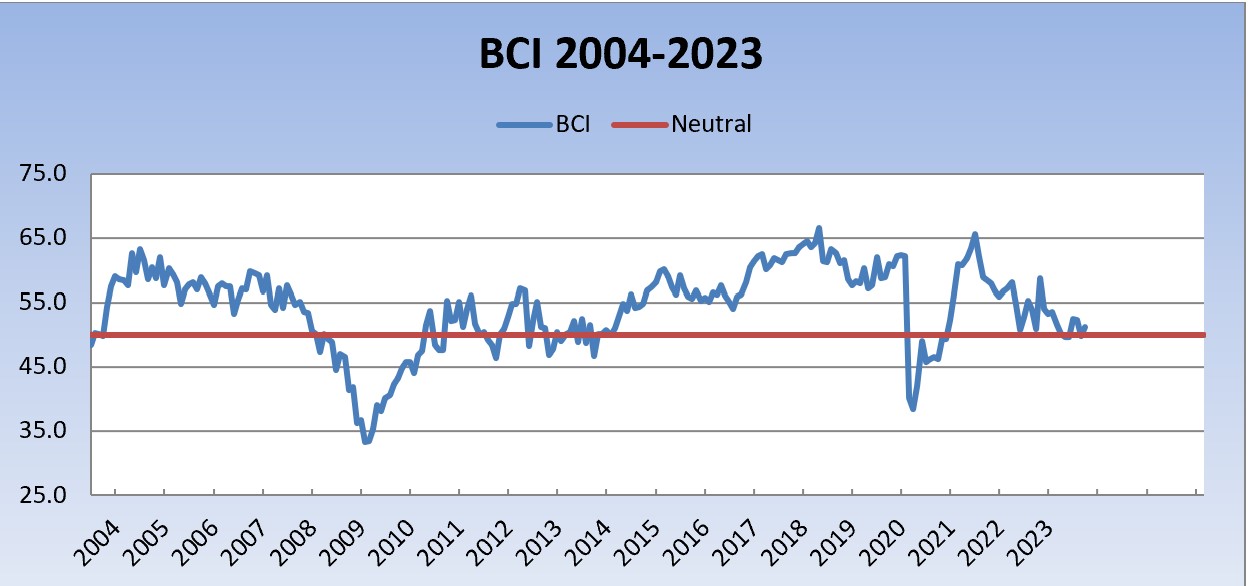

The monthly Business Confidence Index, initiated by AIM’s Board of Economic Advisors in July 1991, is based on a survey of AIM member companies across Massachusetts, asking questions about current and prospective business conditions in the state and nation, as well as for respondents’ own operations. On the Index’s 100-point scale, a reading above 50 indicates that the state’s employer community is predominantly optimistic, while a reading below 50 points to a negative assessment of business conditions. Several component sub-indices are derived by analyzing responses to selected questions or those of groups of respondents.

Media Contacts:

Sara L. Johnson (Chair), 781-235-9479, saralynnjohnson@verizon.net

Michael A. Tyler, CFA, (Vice Chair) Chief Investment Officer, Eastern Bank Wealth Management 617-897-1122

Marcelo Suárez–Orozco, Ph.D., Chancellor, University of Massachusetts, Boston (617) 287-6800

Simona M. Mocuta, Chief Economist at State Street Global Advisors

Alan Clayton-Matthews, Ph.D., Professor Emeritus of Economics & Public Policy, Northeastern University; Senior Contributing Editor, MassBenchmarks (617) 512-6224

Edward H. Pendergast, Managing Director, Dunn Rush & Co., (617) 821-0130

Elmore Alexander, Dean Emeritus, Ricciardi College of Business, Bridgewater State University, 267-980-4652

Nada Sanders, Distinguished Professor of Supply Chain Management, Northeastern University, 614-284-3908

Michael D. Goodman, Ph.D., Professor of Public Policy, UMass Dartmouth 617-823-2770

Olena Staveley-O’Carroll, Ph.D., Associate Professor of Economics, College of the Holy Cross, (508) 793-2736

Suzanne Dwyer, President, Massachusetts Capital Resource Company 617-536-8251

Jim Sibley, Regional Commissioner, Bureau of Labor Statistics

Barry Bluestone, Ph.D., Professor of Public Policy and Urban Affairs (retired), Northeastern University 617-899-9300

Raymond G. Torto (Emeritus), Ph.D., CRE, Harvard Graduate School of Design 617-930-6625

John R. Regan, CEO, Associated Industries of Massachusetts 617-262-1180

Brooke M. Thomson, President, Associated Industries of Massachusetts 617-262-1180

Christopher Geehern, Executive Vice President, Public Affairs and Communication, Associated Industries of Massachusetts 617-834-4414, @aimbusinessnews