May 1, 2024

Nominees for AIM Board of Directors

The Governance and Nominating Committee of the Associated Industries of Massachusetts Board of Directors has put forward the…

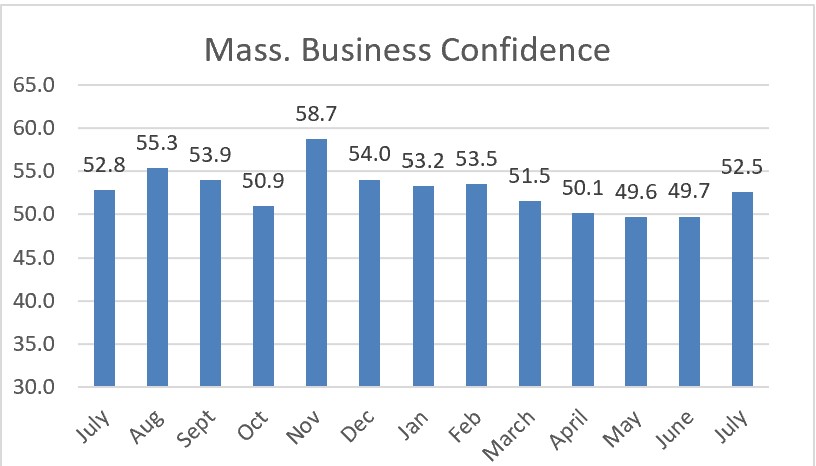

Read MoreBrightening prospects for an economic “soft landing” pushed confidence among Massachusetts employers back into optimistic territory in July.

Massachusetts

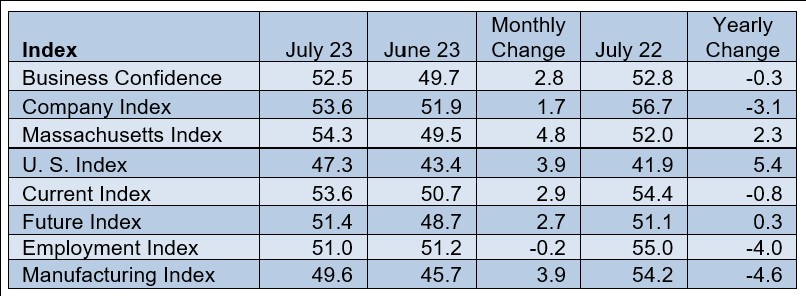

The Associated Industries of Massachusetts Business Confidence Index (BCI) gained 2.8 points to 52.5 last month, surpassing the 50 mark that separates optimistic from pessimistic outlooks. Confidence ended the month three-tenths of a point lower than a year earlier.

The confidence boost came as the United States and Massachusetts economies defied expectations of a recession in the face of 11 interest-rate increases by the Federal Reserve. The nation’s economy grew at a 2.4 percent annual rate in the second quarter, up from 2 percent in the first quarter, while inflation fell to a two-year low of 2.97 percent during June. (The Core Personal Consumption Expenditures Index, which excludes the more volatile food and energy prices and is more accurate at measuring the underlying inflation trends, decreased to 4.1 percent but remains twice the Fed’s target.)

The Massachusetts economy, meanwhile, grew at a 4 percent annual rate during the second quarter and the commonwealth’s unemployment rate now sits at an historic low of 2.6 percent.

“A strong job market, vibrant consumer spending and resurgent business investment continue to move the economy in a positive direction. The job market remains particularly strong, giving Americans money to spend: personal income, after taxes and adjusted for inflation, rose at a 2.5 percent rate in the second quarter,” said Sara Johnson, Chair of the Board of Economic Advisors.

Participants in the Business Confidence Index Survey appeared divided about how quickly the economy is recovering.

“I think people are getting used to interest rates, so inquiries are picking up,” wrote one employer in the technology sector.

But another company wrote: “The hospitality industry is still very much domestic travel. We are seeing limited visitors from Europe (UK / Germany / France) and virtually nothing from other areas of the world. Historically 40% of our clients were from overseas.”

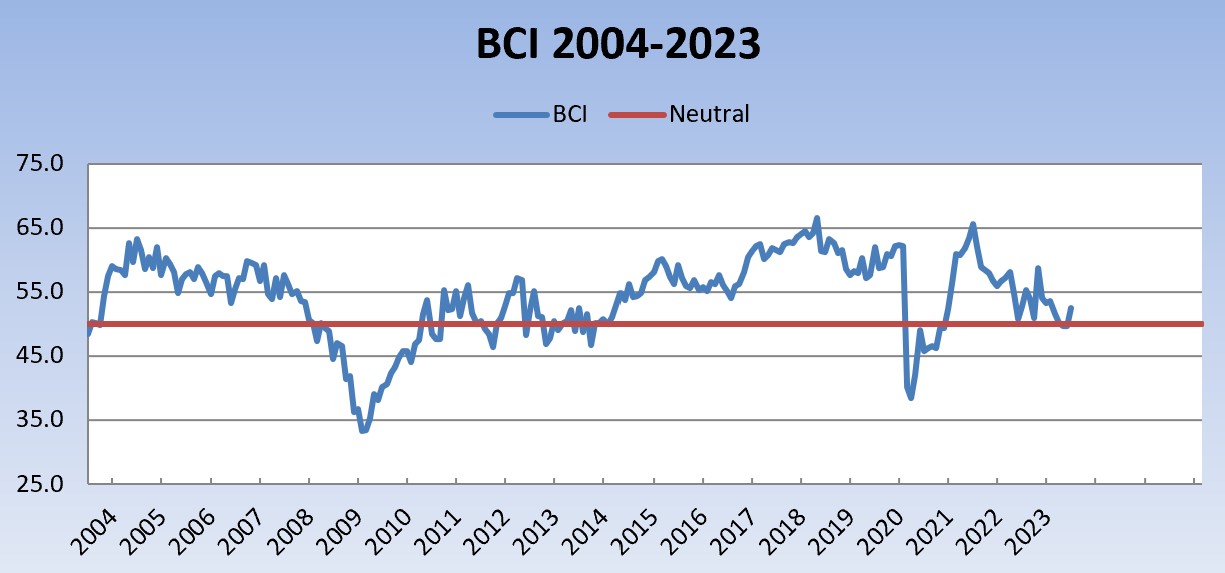

The AIM Index, based on a survey of more than 140 Massachusetts employers, has appeared monthly since July 1991. It is calculated on a 100-point scale, with 50 as neutral; a reading above 50 is positive, while below 50 is negative. The Index reached its historic high of 68.5 on two occasions in 1997-98, and its all-time low of 33.3 in February 2009.

The Central Massachusetts Business Confidence Index, conducted with the Worcester Regional Chamber of Commerce, rose from 46.3 to 52.2. The North Shore Confidence Index, conducted with the North Shore Chamber of Commerce, fell from 55.0 to 52.8. The Western Massachusetts Business Confidence Index, developed in collaboration with the Springfield Regional Chamber of Commerce, surged from 45.7 to 54.3.

Constituent Indicators

The constituent indicators that make up the Index were mostly higher during July.

The confidence employers have in their own companies rose 1.7 points to 53.6, ending the month 3.1 points less than July 2022.

Massachusetts

The Massachusetts Index assessing business conditions within the Commonwealth gained 4.8 points to 54.3, leaving it up 2.3 points from a year earlier. The US Index measuring conditions throughout the country increased 3.9 points to 47.3 but remained in pessimistic territory for a 10th consecutive month.

The Current Index, which assesses overall business conditions at the time of the survey, rose 2.9 points to 53.6. The Future Index, measuring projections for the economy six months from now, gained 2.7 points to end the month at 51.4.

The Manufacturing Index posted a 3.9-point increase point to 49.6 – 4.6 points lower than a year ago. Confidence among non-manufacturing companies was up 2.3 points to 54.4.

The Employment Index was the only indicator to lose ground, falling slightly to 51.0.

Small companies (54.1) were more optimistic than large companies (51.4) and medium-sized companies (51.8).

Nada Sanders, Distinguished Professor of Supply Chain Management, Northeastern University and a member of the BEA, said improvement in the global supply-chain interruptions of 2021 and 2022 has helped to moderate inflation, but that a tight labor market continues to put pressure on wages.

“The supply issues that helped to drive up prices a year ago are slowly improving in most cases. At the same time, it’s no surprise that historically low unemployment rates are pushing wages and salaries up at a 4.6 percent annual rate as of June,” Sanders said.

Tax Relief

AIM Chief Executive Officer John R. Regan, a BEA member, said the Massachusetts Legislature’s passage last week of a $56.2 billion budget for Fiscal Year 2024 should strengthen employer views of the state economy, even though lawmakers did not release a companion tax-reform measure.

“AIM supports parts of the House of Representatives proposals for tax reforms, in particular a component that would reduce the tax on short-term capital gains from 12 percent to 5 percent over two years. AIM also supports raising the threshold for the estate tax from $1 million to $2 million, a much-needed change that is included in both the House and Senate versions. Massachusetts is one of just 12 states with an estate tax,” Regan said.

Massachusetts

The monthly Business Confidence Index, initiated by AIM’s Board of Economic Advisors in July 1991, is based on a survey of AIM member companies across Massachusetts, asking questions about current and prospective business conditions in the state and nation, as well as for respondents’ own operations. On the Index’s 100-point scale, a reading above 50 indicates that the state’s employer community is predominantly optimistic, while a reading below 50 points to a negative assessment of business conditions. Several component sub-indices are derived by analyzing responses to selected questions or those of groups of respondents.

Media Contacts:

Sara L. Johnson (Chair), 781-235-9479, saralynnjohnson@verizon.net

Michael A. Tyler, CFA, (Vice Chair) Chief Investment Officer, Eastern Bank Wealth Management 617-897-1122

Marcelo Suárez–Orozco, Ph.D., Chancellor, University of Massachusetts, Boston (617) 287-6800

Simona M. Mocuta, Chief Economist at State Street Global Advisors

Alan Clayton-Matthews, Ph.D., Professor Emeritus of Economics & Public Policy, Northeastern University; Senior Contributing Editor, MassBenchmarks (617) 512-6224

Edward H. Pendergast, Managing Director, Dunn Rush & Co., 617-451-0001

Elmore Alexander, Dean Emeritus, Ricciardi College of Business, Bridgewater State University, 267-980-4652

Nada Sanders, Distinguished Professor of Supply Chain Management, Northeastern University, 614-284-3908

Michael D. Goodman, Ph.D., Professor of Public Policy, UMass Dartmouth 617-823-2770

Olena Staveley-O’Carroll, Ph.D., Associate Professor of Economics, College of the Holy Cross, (508) 793-2736

Suzanne Dwyer, President, Massachusetts Capital Resource Company 617-536-8251

Jim Sibley, Regional Commissioner, Bureau of Labor Statistics

Barry Bluestone, Ph.D., Professor of Public Policy and Urban Affairs (retired), Northeastern University 617-899-9300

Raymond G. Torto (Emeritus), Ph.D., CRE, Harvard Graduate School of Design 617-930-6625

John R. Regan, CEO, Associated Industries of Massachusetts 617-262-1180

Brooke M. Thomson, President, Associated Industries of Massachusetts 617-262-1180

Christopher Geehern, Executive Vice President, Public Affairs and Communication, Associated Industries of Massachusetts 617-834-4414, @aimbusinessnews