May 1, 2024

Nominees for AIM Board of Directors

The Governance and Nominating Committee of the Associated Industries of Massachusetts Board of Directors has put forward the…

Read MoreIf you are not an AIM member - Consider joining. AIM Members receive access to all our premium content online.

If you're an AIM member please login to your AIM account to view this post:

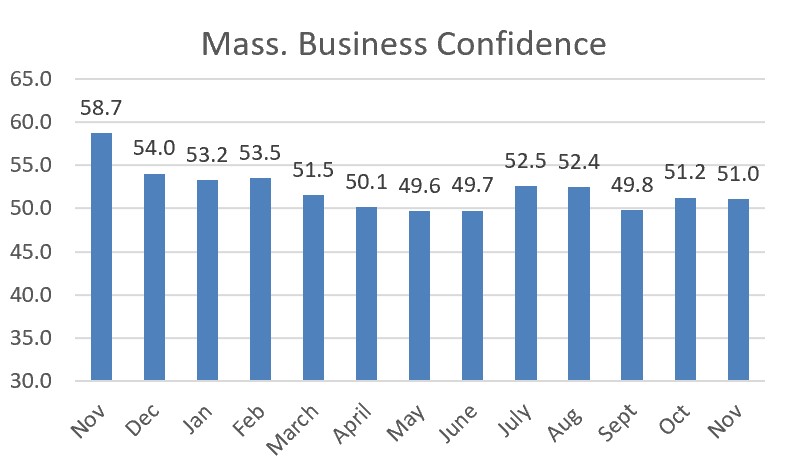

Business confidence remained essentially flat during November amid a softening labor market, cooling wage growth and moderating inflation.

Business Confidence Index

The Associated Industries of Massachusetts Business Confidence Index (BCI) lost two-tenths of a point to 51.0 last month, continuing its pattern of hovering near the dividing line between optimism and pessimism. The Index ended the month 7.7 points lower than the same time last year.

Steady employer sentiment in November reflected a Massachusetts economy that outperformed expectations by growing at a 3.8 percent annualized rate during the third quarter. Nationally, job growth was less than expected in October while wage growth eased to 4.1 percent year over year.

“Strong consumer spending throughout the summer helped the US and Massachusetts economies during a period in which the Federal Reserve has increased interest rates to moderate inflation. The hope is now that the economy will slow in a deliberate manner instead of falling into recession,” said Sara Johnson, Chair of the AIM Board of Economic Advisors.

Participants in the Business Confidence Index Survey confirmed that the economy is cooling.

“Our incoming order rate has decreased significantly in the last few months and is not showing signs of rebounding any time soon,” wrote one BCI survey participant.

A shortage of skilled workers remains an issue.

“The skills gap and lack of qualified CNC machinist candidates is our biggest threat. We need machinists,” another company wrote.

The Central Massachusetts Business Confidence Index, conducted with the Worcester Regional Chamber of Commerce, rose from 45.7 to 49.6. The North Shore Confidence Index, conducted with the North Shore Chamber of Commerce, declined from 54.2 to 52.2. The Western Massachusetts Business Confidence Index, developed in collaboration with the Springfield Regional Chamber of Commerce, also lost ground, from 54.1 to 51.8.

Constituent Indicators

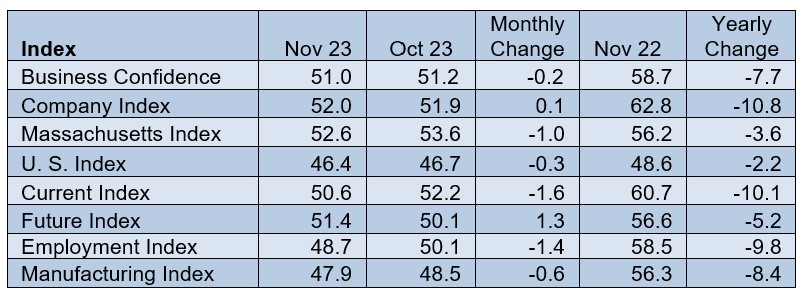

The constituent indicators that make up the Index were mixed during November.

The confidence employers have in their own companies gained 0.1 point to 52.0, ending the month 10.8 points less than in November 2022.

Business Confidence Index

The Massachusetts Index assessing business conditions within the Commonwealth decreased 1.0 point to 52.6, leaving it down 3.6 points from a year earlier. The US Index measuring conditions throughout the country ended the month at 46.4 – 2.2 points lower than a year ago.

The bright spot of the November numbers was the Future Index, which gained 1.3 points to 51.4 as employers saw improvement ahead in the first six months of 2024. The Current Index, which assesses overall business conditions at the time of the survey, fell 1.6 points to 50.6.

The Manufacturing Index lost 0.6 point to 47.9, falling 8.4 points below its level of a year ago. Confidence among non-manufacturing companies was up 0.8 point to 52.9.

The Employment Index fell 1.4 points to 48.7.

Large companies (54.2) were more optimistic than medium-sized companies (51.7) and small companies (47.8).

Elmore Alexander, Dean Emeritus of the Ricciardi College of Business at Bridgewater State University, and a BEA member, said the white-hot job market both in Massachusetts and nationally appears to be approaching equilibrium, reducing inflationary pressure on wages.

“The US economy added 150,000 jobs in October and job growth in August and September was revised down by a cumulative 101,000 jobs. The Massachusetts unemployment rate, meanwhile, rose to 2.8 percent,” Alexander said.

Wage Moderation

AIM President Brooke Thomson, also a BEA member, confirmed that the association is seeing signs of wage moderation among its 3,400 members.

“The AIM HR Practices Survey to be published later this month will show that employers plan somewhat smaller wage increases in 2024 than in 2023. Those projections are consistent with national trends – wage growth has been slowing steadily since March and overall inflation cooled to 3.2 percent in October.”

Business Confidence Index

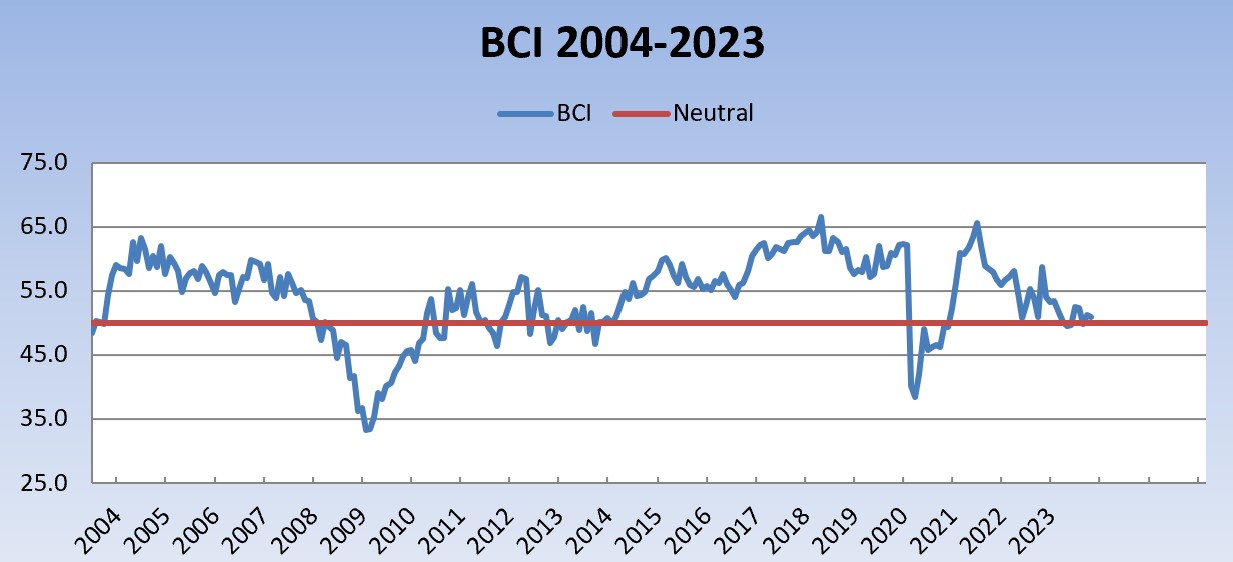

The monthly Business Confidence Index, initiated by AIM’s Board of Economic Advisors in July 1991, is based on a survey of AIM member companies across Massachusetts, asking questions about current and prospective business conditions in the state and nation, as well as for respondents’ own operations. On the Index’s 100-point scale, a reading above 50 indicates that the state’s employer community is predominantly optimistic, while a reading below 50 points to a negative assessment of business conditions. Several component sub-indices are derived by analyzing responses to selected questions or those of groups of respondents.

Media Contacts:

Sara L. Johnson (Chair), 781-235-9479, saralynnjohnson@verizon.net

Michael A. Tyler, CFA, (Vice Chair) Chief Investment Officer, Eastern Bank Wealth Management 617-897-1122

Marcelo Suárez–Orozco, Ph.D., Chancellor, University of Massachusetts, Boston (617) 287-6800

Simona M. Mocuta, Chief Economist at State Street Global Advisors

Alan Clayton-Matthews, Ph.D., Professor Emeritus of Economics & Public Policy, Northeastern University; Senior Contributing Editor, MassBenchmarks (617) 512-6224

Edward H. Pendergast, Managing Director, Dunn Rush & Co., (617) 821-0130

Elmore Alexander, Dean Emeritus, Ricciardi College of Business, Bridgewater State University, 267-980-4652

Nada Sanders, Distinguished Professor of Supply Chain Management, Northeastern University, 614-284-3908

Michael D. Goodman, Ph.D., Professor of Public Policy, UMass Dartmouth 617-823-2770

Olena Staveley-O’Carroll, Ph.D., Associate Professor of Economics, College of the Holy Cross, (508) 793-2736

Suzanne Dwyer, President, Massachusetts Capital Resource Company 617-536-8251

Jim Sibley, Regional Commissioner, Bureau of Labor Statistics

Barry Bluestone, Ph.D., Professor of Public Policy and Urban Affairs (retired), Northeastern University 617-899-9300

Raymond G. Torto (Emeritus), Ph.D., CRE, Harvard Graduate School of Design 617-930-6625

John R. Regan, CEO, Associated Industries of Massachusetts 617-262-1180

Brooke M. Thomson, President, Associated Industries of Massachusetts 617-262-1180

Christopher Geehern, Executive Vice President, Public Affairs and Communication, Associated Industries of Massachusetts 617-834-4414, @aimbusinessnews