May 1, 2024

Nominees for AIM Board of Directors

The Governance and Nominating Committee of the Associated Industries of Massachusetts Board of Directors has put forward the…

Read MoreIf you are not an AIM member - Consider joining. AIM Members receive access to all our premium content online.

If you're an AIM member please login to your AIM account to view this post:

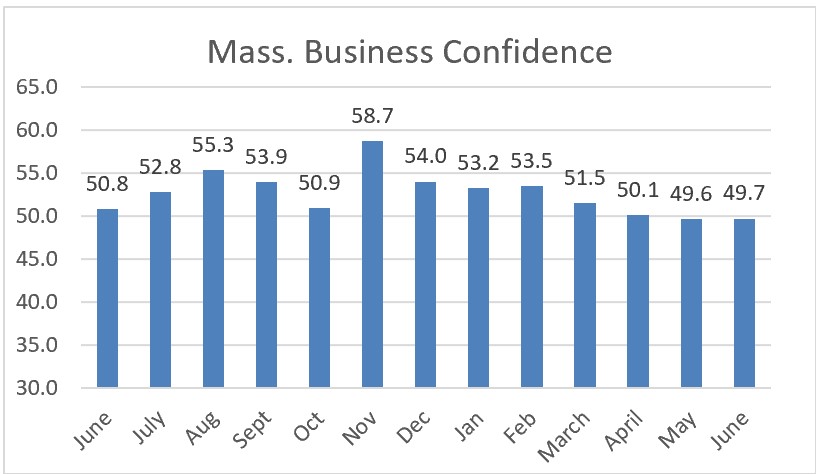

Business confidence remained flat during June amid a resilient economy, stubborn inflation, a pause by the Federal Reserve and a shortage of workers across almost every industry.

The Associated Industries of Massachusetts Business Confidence Index (BCI) gained 0.1 point to 49.7, just below the 50 mark that separates optimistic from pessimistic outlooks. Confidence ended the month 1.1 points lower than a year earlier.

Business Confidence Index

The mixed reading reflects an economy that continues to defy expectations in the face of 10 interest-rate increases by the Federal Reserve. The Fed paused rate increases last month as inflation moderated to 4 percent, but more hikes are likely since the Fed’s target inflation rate is 2 percent.

Though many national economists believe a recession remains probable, the Massachusetts job market remains strong with the unemployment rate dropping to 2.8 percent in May.

“As 2023 reached its midpoint, we experienced a tech-fueled stock market rally instead of the recession many economists believe is inevitable. Employers tell us that even though they worry about rising prices, they also remain desperate to find workers in a tight labor market,” said Sara Johnson, Chair of the Board of Economic Advisors.

Participants in the Business Confidence Index Survey noted the persistent challenge of finding employees.

“Our primary problem remains attracting qualified staff members,” wrote on central Massachusetts employer.

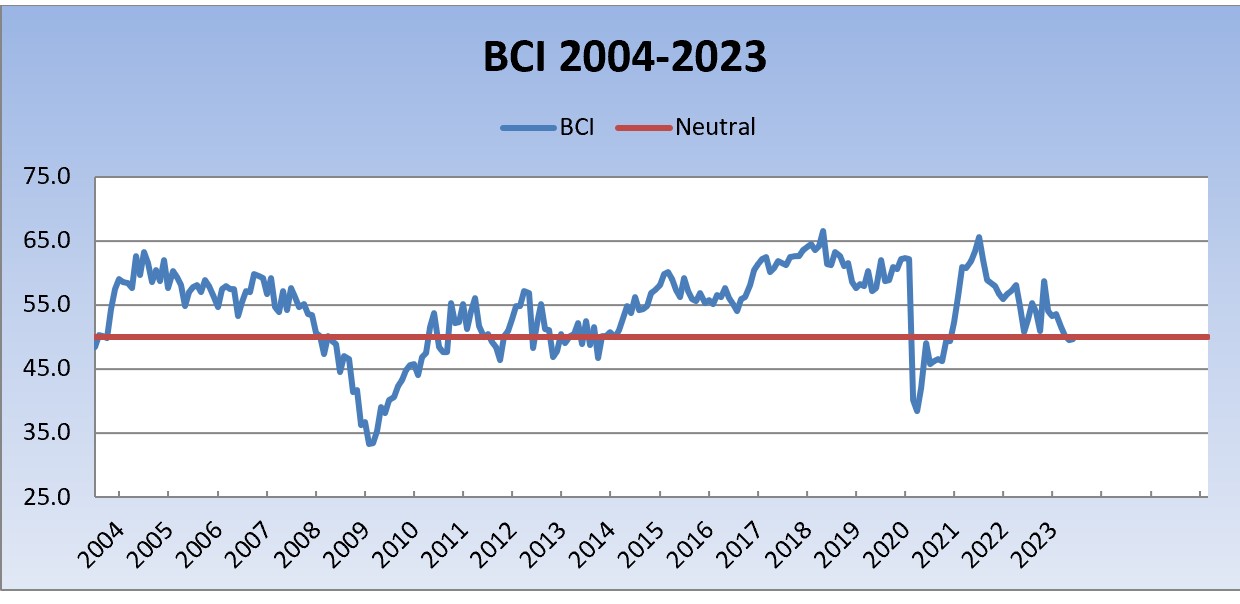

The AIM Index, based on a survey of more than 140 Massachusetts employers, has appeared monthly since July 1991. It is calculated on a 100-point scale, with 50 as neutral; a reading above 50 is positive, while below 50 is negative. The Index reached its historic high of 68.5 on two occasions in 1997-98, and its all-time low of 33.3 in February 2009.

The Central Massachusetts Business Confidence Index, conducted with the Worcester Regional Chamber of Commerce, fell from 50.4 to 46.3. The North Shore Confidence Index, conducted with the North Shore Chamber of Commerce, increased from 50.5 to 55.0. The Western Massachusetts Business Confidence Index, developed in collaboration with the Springfield Regional Chamber of Commerce, was unchanged at 45.7.

Constituent Indicators

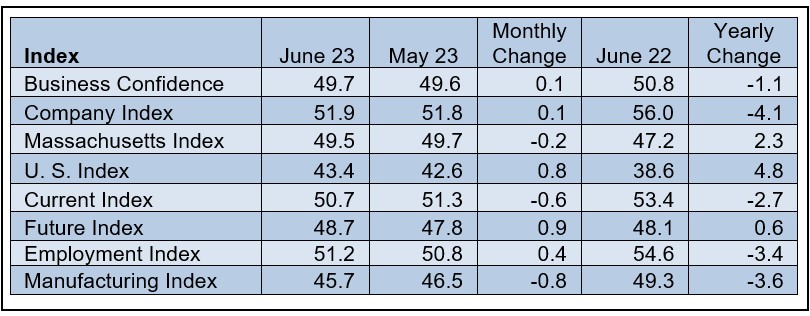

The constituent indicators that make up the Index were mixed in a narrow range during June.

The confidence employers have in their own companies edged up 0.1 point to 51.9, ending the month 4.1 points less than June 2022.

Business Confidence Index

The Massachusetts Index assessing business conditions within the Commonwealth fell 0.2 point to 49.5, leaving it up 2.3 points from a year earlier. The US Index measuring conditions throughout the country gained 0.8 point to 43.4, remaining in pessimistic territory for a ninth consecutive month.

The Current Index, which assesses overall business conditions at the time of the survey, fell 0.6 points to 50.7. The Future Index, measuring projections for the economy six months from now, gained 0.9 point to end the month at 48.7.

The Manufacturing Index dropped 0.8 point to 45.7, ending the month 3.6 points lower than a year ago. Confidence among non-manufacturing companies was up 0.3 points to 52.1.

The Employment Index gained 0.4 point to 51.2.

Small companies (51.2) were slightly more optimistic than large companies (49.6) and medium-sized companies (48.5).

Marcelo Suárez–Orozco, Chancellor of the University of Massachusetts/Boston and a member of the BEA, said the presence of a worker shortage even in a slowing economy underscores the importance of educational institutions preparing the next generation of employees, especially the fast-growing demographic of immigrant-origin students.

“The only group growing enrollments in higher education is immigrant origin students — and they are projected to be the primary group driving growth of the US labor market into 2035. They play a particularly important role in the science, technology, engineering, and math sector of the economy,” Suárez–Orozco said.

Tax Relief

AIM Chief Executive Officer John R. Regan, a BEA member, said employers have been encouraged by the fact that all three elements of Massachusetts state government – Governor Maura Healey, the House of Representatives and the Senate – have passed versions of tax reform. Tax changes will at once improve the commonwealth’s economic competitiveness while also helping individuals struggling with rising costs for food, housing and other staples.

“The governor and the House are wisely seeking tax changes that will improve our economic climate that has seen tens of thousands of Massachusetts residents leave the state in recent years. We look forward to the final version of tax relief from the conference committee,” Regan said.

Business Confidence Index

The monthly Business Confidence Index, initiated by AIM’s Board of Economic Advisors in July 1991, is based on a survey of AIM member companies across Massachusetts, asking questions about current and prospective business conditions in the state and nation, as well as for respondents’ own operations. On the Index’s 100-point scale, a reading above 50 indicates that the state’s employer community is predominantly optimistic, while a reading below 50 points to a negative assessment of business conditions. Several component sub-indices are derived by analyzing responses to selected questions or those of groups of respondents.

Media Contacts:

Sara L. Johnson (Chair), 781-235-9479, saralynnjohnson@verizon.net

Michael A. Tyler, CFA, (Vice Chair) Chief Investment Officer, Eastern Bank Wealth Management 617-897-1122

Marcelo Suárez–Orozco, Chancellor, University of Massachusetts, Boston (617) 287-6800

Alan Clayton-Matthews, Ph.D., Professor Emeritus of Economics & Public Policy, Northeastern University; Senior Contributing Editor, MassBenchmarks (617) 512-6224

Edward H. Pendergast, Managing Director, Dunn Rush & Co., 617-451-0001

Elmore Alexander, Dean Emeritus, Ricciardi College of Business, Bridgewater State University, 267-980-4652

Nada Sanders, Distinguished Professor of Supply Chain Management, Northeastern University, 614-284-3908

Michael D. Goodman, Ph.D., Professor of Public Policy, UMass Dartmouth 617-823-2770

Olena Staveley-O’Carroll, Associate Professor of Economics, College of the Holy Cross, (508) 793-2736

Suzanne Dwyer, President, Massachusetts Capital Resource Company 617-536-8251

Jim Sibley, Regional Commissioner, Bureau of Labor Statistics

Barry Bluestone, Ph.D., Professor of Public Policy and Urban Affairs (retired), Northeastern University 617-899-9300

Raymond G. Torto (Emeritus), Ph.D., CRE, Harvard Graduate School of Design 617-930-6625

John R. Regan, CEO, Associated Industries of Massachusetts 617-262-1180

Brooke M. Thomson, President, Associated Industries of Massachusetts 617-262-1180

Christopher Geehern, Executive Vice President, Public Affairs and Communication, Associated Industries of Massachusetts 617-834-4414, @aimbusinessnews